We have long argued that, given the small-scale nature of private sector bond markets in the euro area and the fact that a negative deposit rate provides a disincentive to euro area banks to hold excess liquidity, the only way that the ECB could significantly increase its balance sheet was via the purchase of sovereign bonds. And it has been obvious for a while that Draghi, and some other members of the Governing Council, are of the same view. We had, however, doubted whether Draghi had the resolve to force through sovereign QE in the face of entrenched opposition from the German members of the Governing Council in particular.

But the case for QE, which has been strong for months now, is now compelling. A perfect storm has set in that looks set to give the Governing Council the final nudge to push ahead with sovereign QE. Most notably, of course, against a backdrop of an already slowing economy, the fall in global oil prices is pushing the euro area ever closer to deflation. Headline CPI hit a new 5-year low of 0.3%Y/Y in November and, assuming that oil prices bottom out around $55pb, headline inflation looks set to fall to -0.3%Y/Y in February. And inflation will likely remain at or below zero for most of 2015 in the absence of what looks to be an unlikely rebound in oil prices.

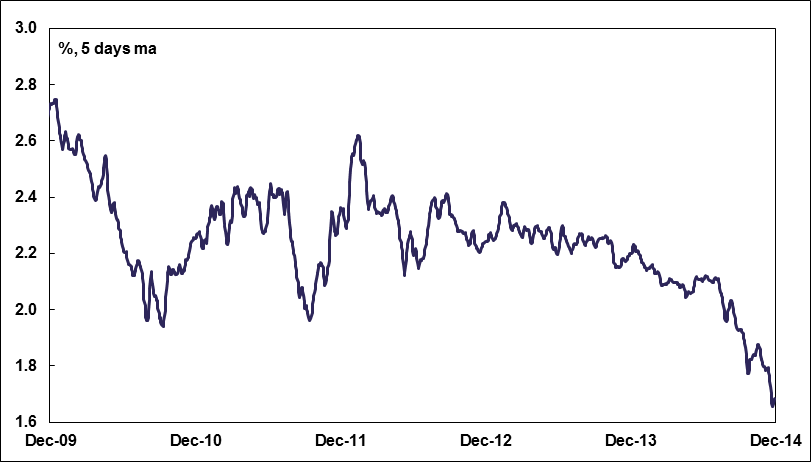

The risk is, of course, that a seemingly temporary period of deflation becomes entrenched via lower inflation expectations and wage-setting behaviour. Certainly, financial market expectations of inflation have fallen markedly over recent months. In late July, 5Y/5Y swap-implied expectations stood at 2.10%. But ever since the ECB failed to follow through at its September meeting on the expectations of QE stoked by Draghi at Jackson Hole, 5Y/5Y rates have fallen sharply and last week hit an all-time low of 1.59%, with each subsequent disappointment from the Governing Council further pushing inflation expectations lower. The need for decisive action to increase the size of the balance sheet and send an unambiguous signal to firms, consumers and markets that the ECB is not willing to tolerate below-target inflation has never been greater.

Euro area: 5Y/5Y inflation expectations*

*Market expectations for 5-year CPI inflation in five years’ time derived from inflation swaps. Source: Bloomberg and Daiwa Capital Markets Europe Ltd.

*Market expectations for 5-year CPI inflation in five years’ time derived from inflation swaps. Source: Bloomberg and Daiwa Capital Markets Europe Ltd.

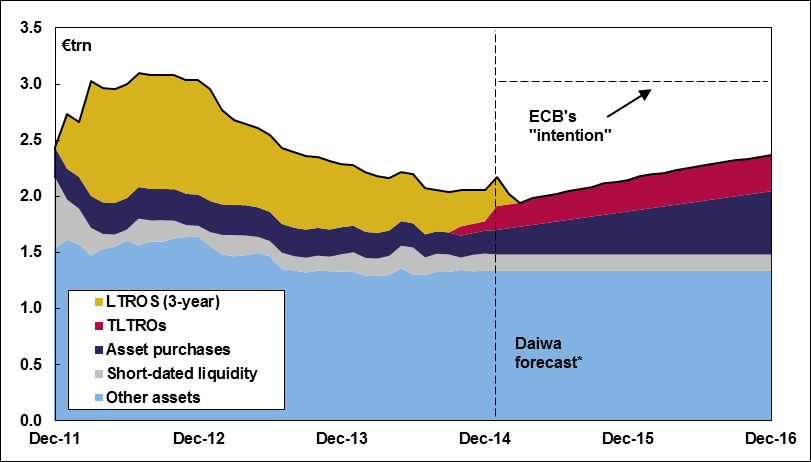

But there is simply no way that, with the current policy settings, the ECB will be able to get its balance sheet up to its “intention” of €3trn. As the latest LTRO operation demonstrated, banks are unsurprisingly simply not willing to hold large amounts of excess cash when the ECB is then charging them to put the cash back with it on deposit. Meanwhile, the ECB’s purchases of covered bonds and ABS have been averaging just €16bn/month. With €250bn of LTRO loans maturing in January and February, at the current pace of asset purchases, the ECB’s balance sheet looks set to shrink from just under €2.2trn currently to below €2trn by March’15 (see chart). And the simple fact is that, without additional measures to boost the balance sheet, the ECB will never get it to €3trn.

Eurosystem: Balance sheet (asset side)*

*Asset purchases projected using current rate of purchases; €100bn additional TLTRO take-up in tenders 3 through 8 assumed. Source: Datastream, ECB and Daiwa Capital Markets Europe Ltd.

*Asset purchases projected using current rate of purchases; €100bn additional TLTRO take-up in tenders 3 through 8 assumed. Source: Datastream, ECB and Daiwa Capital Markets Europe Ltd.

Certainly the realisation that the TLTROs will not be sufficient to significantly increase the size of the balance sheet has led to even some of the more hawkish members of the Governing Council, including Austrian member Nowotny, to admit that QE may be required. But possibly the most notable speech came from ECB chief economist Praet, who made the strongest case yet for sovereign bond-buying, noting that sovereign bond-buying could have a stronger impact by signalling the ECB’s commitment to boost inflation and promoting portfolio rebalancing, including encouraging loan creation. And, he argued, only via sovereign bonds could large purchase volumes be ensured. And with Finland’s Liikanen stressing in December that the ECB’s required ability to take action under all circumstances was more important than unanimity, some presumed QE opponents have clearly changed tack. Are all lights now finally set to green for QE?

Probably – there is a sense that sovereign QE is now just a matter of when, not if. But whether Draghi actually pushes the button in January is likely to come down to his political judgement. Knowing that German monetary ideology is seemingly impervious to deflation, Draghi may well have come to the conclusion that German opposition is an eternal fact of life, but one that can no longer act as a blocking minority to the right monetary policy for the euro area. And with the Governing Council now moving to a system of rotation in terms of votes, Draghi may now feel that the need for Governing Council unanimity is now dead by construction. To us, an announcement of further QE in January, possibly of up to €1trn, but perhaps not becoming operational until after the March meeting, now look the most likely outcome.

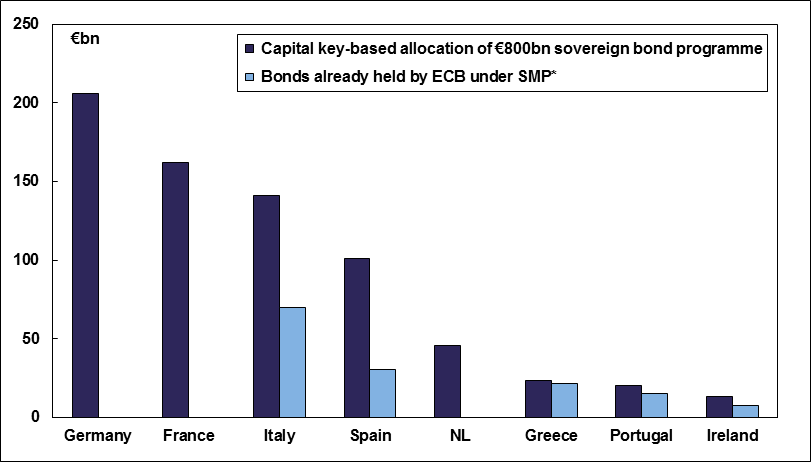

So what would such a sovereign QE scheme look like? While the addition of corporate bonds to a widened asset purchase programme seems likely, it is government bond purchases that will be needed to do the heavy lifting. Judging by the relative size of the pool of ECB-eligible central government bonds relative to corporate bonds, a plausible split might be 80/20. And those sovereign bond purchases are almost certainly going to be undertaken in relation to countries’ capital keys at the ECB.

But, as ever with the ECB, the asset purchase programme is unlikely to be entirely straightforward. Indeed, perhaps reflecting that they have already lost the argument about QE, German Governing Council members have shifted their focus to limiting the scope of sovereign QE. First, the ECB of course already owns some government bonds via its SMP programme. At German insistence, any further ECB buying is likely to take these holdings into account already. This would make a big difference to the net new amounts the ECB will buy of peripheral government bonds.

ECB: Sovereign bond holdings

*Daiwa estimate for December 2014. Source: ECB and Daiwa Capital Markets Europe Ltd.

*Daiwa estimate for December 2014. Source: ECB and Daiwa Capital Markets Europe Ltd.

But even that will not assuage the fears of Governing Council members who fret about the risks to the ECB’s balance sheet of owning government bonds (the ECB would have to renounce any thoughts of preferred creditor status if it didn’t want to undermine the effectiveness of QE). Hence the suggestion from some Governing Council members that national central banks should provision for and absorb any eventual losses on sovereign bonds. But while this may superficially shield the ECB (and hence other member states) from losses, it would undermine the principle of a single currency and risk raising the relative credit risk on peripheral sovereign bonds given that the sovereign would ultimately be responsible for any losses.

Both therefore have the drawback of limiting the impact of QE on easing financing conditions in the periphery, where it is needed most. And it would potentially aggravate financial fragmentation as yields in the core fall further than in the periphery. But, perhaps more importantly, it would once again leave an impression that the ECB is not prepared to do “whatever it takes” to ward off deflation, held back by recalcitrant countries.

Indeed, the desire to date to do anything but QE, which has included the introduction of negative rates, actually makes QE more difficult to implement. Negative deposit rates make owners of bonds less likely to exchange those positive-yielding instruments for negative-yielding cash. And they have also pushed short-dated yields into negative territory. Given that the ECB will not want to (and legally probably can’t) buy bonds that are capital destructive, that will force its purchases further along the curve, which will be undesirable for many members of the Council, who will fear that the longer the average maturity of the ECB’s holdings, the longer it will be until the ECB can get the bonds off its books. The ECB could, of course, reverse its negative deposit rate. But this would amount to an admission of error (albeit a justified one), contradict its forward guidance, tighten the monetary policy stance and confuse the ECB’s message.

The ECB was, of course, originally modelled on the German Bundesbank. Subsequently it has gradually morphed into something the Germans think is at odds with the legacy of their highly-regarded institution. But the ECB has faced challenges never faced by the Bundesbank; challenges that have forced it into increasingly unconventional measures – had the German central bank faced these same challenges, it almost certainly would have ended up where the ECB is now. The power of the Bundesbank’s legacy has, however, meant that the ECB’s slide into the unconventional has been both hesitant and often only when forced to act under the acute pressure of the euro crisis. This, in itself, has undermined the effectiveness of its monetary policy actions. And if, when unveiling the next round of QE, this legacy continues to leave the impression that “whatever it takes” remains constrained by divisions in the Council, its effectiveness too will be undermined. So while the ECB may be set to hit uncharted waters with sovereign QE, the Bundesbank’s shadow, while perhaps not as dark as it once was, is still likely to loom large.